Ownership Spectrums

Why future token concepts should be simple

In 2016, after the Chicago Cubs won their first World Series in 108 years, a post went viral. Apparently, a high school student predicted this exact outcome, 23 years ago. But unless he made an official sports bet on that prediction, the only thing he gained was a bit of temporary fame.

Is money the only collateral we can risk? Web3 protocols disagree. In Kinjal Shah’s “Crypto’s Consumer Era,” she writes:

Crypto enables ownership from day one — a powerful concept. For the first time, users can partake in the growth and success of the products and communities they are a part of, from the beginning. Ownership changes the model from extractive to additive. The main mechanism for ownership has been via tokens - whether they are fungible or non-fungible. Tokens offer users the ability to partake in governance, access user benefits, and more. Tokens turn users into advocates. Each additional user in a given network benefits alongside the entire network. Rather than providing content, time, attention for free, they are rewarded for making products and services successful.

By “tokenizing” apps and protocols, users have a bigger incentive to stay loyal. You stand to gain both monetary and status rewards with the token’s success, which aligns the user and protocol’s goals.

Current Token Design is Complex

Ideally, tokens are like happy meal toys. Most people buy a happy meal for the food. The toy is just a nice bonus, not a substitute for the food itself. Similarly, tokens should represent ownership of a good product, not replace it.

Tokens can also unlock many abilities. Just take a look at this chart from Eddy Lazzarin to see everything they’re capable of.

Even a quick glance at the chart shows how confusing tokens can get. The traditional definitions of shareholders and stakeholders have blurred. Users have become owners. One protocol might have a token that allows you to vote and help direct their future, and another might have a token that simply acts as a proof of membership.

le think of it as. The app suffered from a problem many social apps face — virality before product-market fit. However, most products that face this problem simply fizzle out; so why did STEPN cause controversy? Because users were motivated mostly by profit, not product, when they joined.

If there’s one thing we know about humans, it’s that motivation matters. The app focused more on the tokenization of walking than about the app’s utility without money. And when token incentives become more important to the core product, web3 products fail. This thread by Li Jin gives a likely solution:

There seems to be a large delta between the crypto community’s vision of effective tokens and their implementation. These complex tokenomics often overcomplicate community buy-in.

Future Token Systems Will Be Simple

I believe that effective user ownership in web3 will start simply.

Rather than unlocking a dozen different abilities for the users, we could see something like an ownership spectrum. Essentially, rather than having one token that gives holders multiple abilities, they will exist separately.

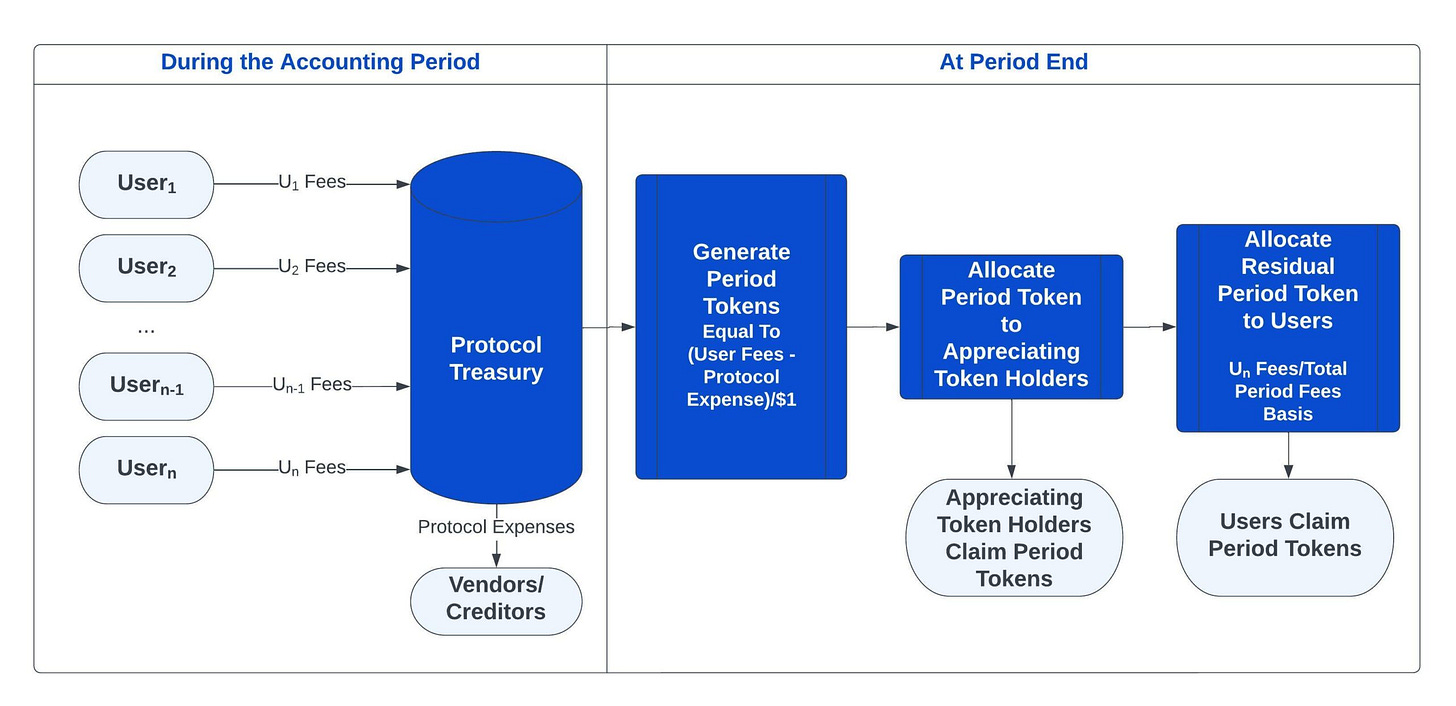

Caleb Shough’s “Hybrid Ownership” discusses this in further detail. He proposes a token model that reflects the owner’s level of proven loyalty. Any user can earn patronage tokens that reflect their participation over a period of time (similar to an airdrop). After a period of time, profits are paid out to the users but their governance ability decreases.

Meanwhile, founders, team members, and dedicated community members receive an appreciating token that entitles them to a percentage of this patronage pool. Rather than pushing new users off the deep end with an overabundance of abilities, this design allows all users to benefit from greater ownership while gradually expanding the use cases for those who demonstrate more loyalty.

Alternatively, tokens could be used as startup prophecies, as Packy McCormick explains.

Why not mint an NFT whenever you’re bullish on a new company? Or maybe a story, piece of art, or song? He points to the abundance and profit-earning potential of vintage company memorabilia as the reasoning for this space’s potential. But as I’ve mentioned, people are more likely to begin as users, not shareholders or investors. A token design under the hybrid ownership model would allow them to start accumulating benefits as an early adopter, while preventing incentive misalignment.

This model has worked for web2 consumer products already. Fortnite rewards players with a non-purchasable “Victory Umbrella” specific to each season, but sells millions of dollars worth of cosmetic items as well. By the same token, web3 protocols could focus on token appreciation through collectability and product growth, naturally increasing the value of protocol-specific tokens.

One of David Phelps’ 2023 crypto theses is that “the solution to low governance participation is to lower governance participation even further.” I agree. Protocols should encourage community involvement, but not force it through complex abilities or a focus on financial incentives. A token-enabled ownership spectrum will likely be most appealing to users.